PERSONAL LOAN Money With Bank Employees Approve Contract Stock Image Image of coffee, concept

Workers Welcome to Financial Freedom with Loans for Workers Explore the convenience and ease of our Loans for Workers. We offer low-cost loans designed with you in mind. Borrow responsibly and enhance your financial wellness. No high-interest rates, no stress - only a sensible way towards a financially secure future. Offers: 6 By date Updated:

Workers' Compensation Loans What You Need To Know

Personal loans for casual workers Your work may be on and off, but that doesn't mean applying for credit should be hit or miss. Compare personal loans for casual workers now to find lenders that understand your budget and needs. Calculate your repayments Loan amount Term Provider Product Information EST Monthly Repayment Advertised Rate Comparison

The 7 Types of Business Loans Available on the Market Today Debthunch

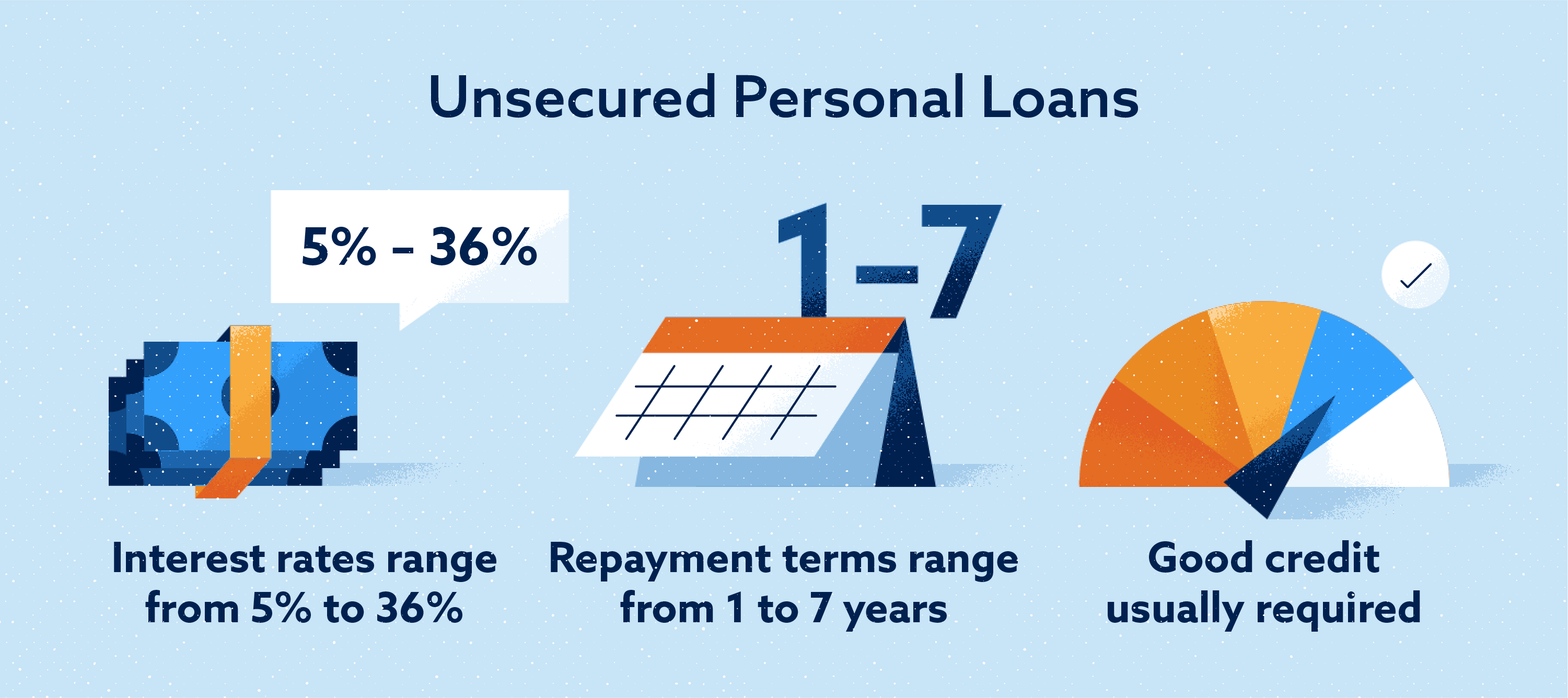

A Salary Finance loan is an unsecured personal loan that should be used solely for personal, family, or household purposes. Most of our borrowers take out their loan to pay down existing, higher-cost debt, like credit cards, payday loans, or medical bills. Your Salary Finance loan cannot be used for expenses like real estate, business purposes.

Home loans for casual workers

Loans for casual and part-time workers Casual and part-time workers can take out a personal loan. It really helps to show proof of regular income and regular savings. The better your credit score, the better your odds of approval. By Rebecca Pike Reviewed by Richard Whitten Updated Oct 11, 2023 Fact checked Refine results Share my filters

How They Work Personal Loans YouTube

Before you borrow, learn what you need to get a loan as a casual or part-time worker. Personal loans are accessible to casual and part-time workers in Australia. With the right lender, proper documentation, and financial responsibility, you can secure a loan that helps you achieve your financial goals.

.png)

An overview of the main casual worker agreements

A loan for many purposes When you work part-time or casually, being flexible with your finances is of the utmost importance. Being able to use the loan on whatever you may need to get you through until your next pay day can be incredibly helpful. That flexibility is exactly what you'll get from Credit24's part-time and casual workers loan.

Here are 6 Things to do Before Applying for a Business Loan Afinoz Business loans, How to

What is GovLoans.gov? GovLoans.gov is an online resource to help you find government loans you may be eligible for. It is not an application for benefits and will not send you free money.

How Does an Installment Loan Work Exactly?

Home Loan Casual Employment You might be eligible for a home loan today 60% Market average loan approval rate 97% our loan Approval rate 1217 5 star Reviews on google Are you ready to buy a home but have been knocked back by your bank because you are in casual employment? Don't worry!

6 Types of Personal Loans (and How They Can Help You)

Compare your loan options: After prequalifying, compare the preliminary loan offers. Look at the APR, repayment period and any fees, including origination fees and early repayment penalties.

Documents Required for Personal Loans for Salaried and Self Employed

Getty. The personal loan amount you can qualify for is typically determined by your credit score, income, debt-to-income ratio and other factors. Although loan amounts vary across lenders, the.

Can You Get A Home Loan With A Casual Job Job Drop

Personal loans for casual and part time workers If you're a casual or part-time employee, you can still secure a personal loan. But there are a few things you should know first. Harry O'Sullivan Graduate Finance Journalist Fact Checked Rates updated 9 hours ago Loan duration Loan amount Update results Compare Rates Features Fees Other

How Does A Personal Loan Work? Loans 101 YouTube

Loan Approved In Minutes No Fees & Repay 3 - 36 Months Apply Now! Lenders Online. Fast & Easy Loan All Credit Types Ok Same Day Approval Get Started Now Quick Decision

EmployerEmployee Loans and the National Credit Act SERR Synergy

NerdWallet's Fast Personal Loans: Best Lenders for Quick Cash in 2024. SoFi Personal Loan: Best for Same-day approval, same-day funding. LightStream: Best for Same-day approval, same-day funding.

Can You Get A Home Loan With A Casual Job Job Drop

The most common type of home loan for casual workers is a low doc home loan, which is a mortgage that is designed for the self-employed or those who receives an irregular income, rather than a consistent PAYG income. These types of loans are considered to be riskier than a regular home loan, so they often charge slightly higher interest rates.

Getting a Home Loan for Casual Workers Your Mortgage

Mar 2, 2023 Fact checked If you work part time and want to apply for a loan, the process can be a little more complicated than it would be for your full-time coworkers. That's because lenders have to work harder to verify your ability to repay a loan.

Building Your Credit Profile With A Personal Loan Finance Sesame

Personal Loans For Casual Employees Search and compare casual employee personal loans Don't feel locked out of the market because you're not employed on a full-time basis. Compare personal loans for casual employees and find one that's right for you. Peter Terlato Personal Finance Editor Content updated 27 Oct, 2022